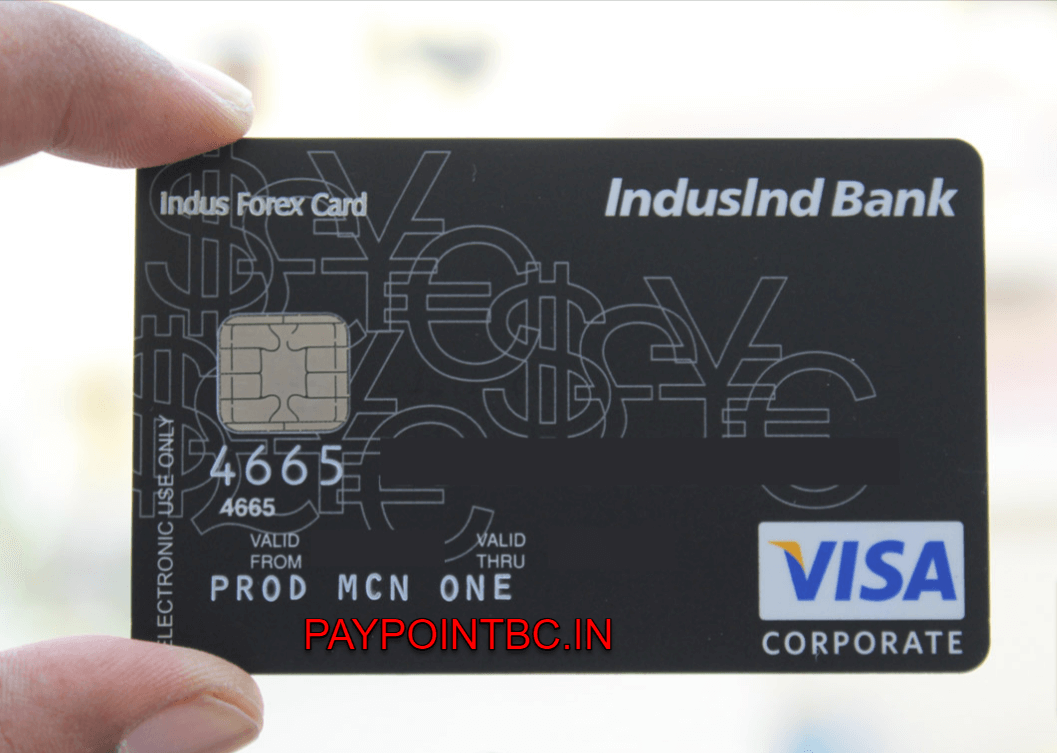

Indus Multicurrency Forex Card provides travelers with an efficient and safe method for carrying foreign currency when traveling overseas. Loaded with 14 currencies at any one time and reloaded multiple times, it also sends immediate alerts via SMS after every transaction takes place.

The card can also be more cost-effective than carrying cash, saving on currency conversion charges and making use of Merchant Outlets and International VISA ATMs easier.

Features and Benefits of Indus Multicurrency Forex

The Indus Multi-Currency Forex Card is an ideal solution for travellers who wish to avoid currency exchange fees while abroad. This prepaid travel card can be preloaded with 14 currencies and used easily at restaurants, hotels and airports worldwide – plus instant transaction alerts and no ATM withdrawal fees!

The Indus Multi-Currency Forex card’s main benefit lies in providing protection from currency fluctuations, something not available with credit or debit cards. Furthermore, this eliminates carrying cash or traveller’s cheques which could pose safety concerns.

READ MORE :- Amazon Credit Card Login

A key advantage of the Indus Multi-Currency forex card is its lack of currency conversion charges, which can be prohibitively expensive with credit cards. This is possible since real-time mid-market rates are used rather than an acquirer’s exchange rate to determine conversion charges.

Indus Multi-Currency Forex also features an app which enables its user to easily view transaction history, manage accounts and load funds onto cards with added convenience. Available both for Android and iOS platforms.

Fees and Charges Indus Multi Currency Travel Card

Forex cards are an indispensable travel companion, especially those who frequently travel internationally. They provide easy payment for flights, Uber rides and other services without needing to carry cash everywhere you go. But be wary of all of their associated fees and charges before purchasing one!

Fees and Charges Indus Multi Currency Travel Card

| Type of Charge | Amount |

|---|---|

| Issuance Fee | Rs.300 |

| Re-issuance of Card fee | Rs.100 |

| Reload fee | Rs.100 |

| Cross Currency | 3.50% mark up |

One of India’s premier forex cards, the Indus Multicurrency Travel Card is one of the best options available to travellers. It allows users to carry 14 currencies in a single wallet while protecting them against exchange rate fluctuations and offers instant notification of transactions as well as tracking expenses through an online portal.

READ MORE :- SBI Kiosk

The Indus Multicurrency Travel Card is an ideal solution for frequent travellers looking to skip currency conversion hassles. It can be used at any merchant or restaurant accepting Visa, and features both chip and magnetic stripe security for point-of-sale purchases. IndusInd Bank branches in India also provide welcome gifts such as hotel stays vouchers. Finally, when your balance runs low you can exchange it at their branches back into your local currency!

Eligibility Criteria for indusind forex

To procure an Indus Multi Currency Travel card, an applicant will have to submit the following documents:-

Listed below are the eligibility criteria for the applicants of Indus Multi Currency Travel Card:

- Applicant must be a bonafide citizen of India planning to travel abroad.

- Corporates are planning to send their employees abroad for official or business purposes (subject to completion of KYC norms).

- Sponsors/parents of students travelling abroad for higher studies. The card will be issued in the student’s name and will be reloaded up to the allowed ceiling, recommended from time to time.

- Expats residing in India (subject to completion of KYC norms).

Forex cards are preloaded cards designed to avoid paying currency conversion fees when making point of sale transactions, similar to debit or credit cards but with additional benefits. Furthermore, you can use it online booking flights, hotels, and other goods – making your travel more hassle free while saving money at the same time!

READ MORE :- AirtelTez Login Portal

The IndusInd Bank Multi-Currency Travel Card makes carrying 14 global currencies simple. Each currency acts like its own wallet; simply buy them before your trip abroad and spend at the point of sale abroad. Plus, this secure card features an embedded chip so you can even withdraw funds from ATMs worldwide!

For travelers planning international trips, this card is an invaluable asset. You can easily track expenses while staying protected against fluctuations in exchange rates. Reloadable, it provides instant alerts regarding all transactions via SMS and email and allows for cashing-in any remaining balance once back home in India. Available at any IndusInd branch worldwide – it provides safe cashless travel overseas!

Documents Required IndusInd Forex Card

When traveling abroad, forex cards offer an ideal solution to carrying money safely. Preloaded with foreign currency, these cards allow users to purchase from restaurants, stores and online websites with ease while remaining safe due to an embedded chip protecting against theft. They’re even handy for withdrawing funds without incurring extra charges at ATMs!

READ MORE :- Bank Of India Mobile Banking

One advantage of using a forex card is being able to lock in an exchange rate when loading money onto it – ideal for students seeking to avoid fluctuating exchange rates. Furthermore, you can track spending and check balance via mobile apps or websites. After your trip ends, all funds can be easily returned back into your bank account.

- Copies of first and last pages of their passport.

- PAN or Form 60 in lieu thereof, in case the amount used is Rs.50,000 or above.

- Proof of address (in case the address is different from that on the passport).

- Documents related to the travel.

IndusInd Bank Multi-Currency Travel Card Welcome B

Those in search of a prepaid travel card capable of being loaded in 14 different currencies will find this card an ideal solution. Reloadable multiple times, it offers instant alerts on every transaction and is simple to use – you can even keep tabs on its balance online!

The IndusInd Bank Multi-Currency Travel Card is an ideal way for travellers looking to save on currency exchange rates and fee charges when making international bookings and payments at hotels, restaurants, airlines, airport stores or petrol pumps abroad. This card features an embedded chip to provide added security as well as being compatible with most major VISA ATMs worldwide.

The IndusInd Bank Avios Visa Infinite Credit Card is a co-branded credit card designed to earn and redeem Avios points with Qatar Airways and British Airways, with one joining fee and an annual fee. Additional perks and benefits of the card include free Priority Pass lounge visits, discounted foreign exchange mark-up rates and travel insurance coverage – making this card ideal for frequent flyers on either airline.

IndusInd Bank Multi-Currency Travel Card Insurance

The IndusInd Bank Multi-Currency Travel Card is a prepaid travel card that enables you to hold 14 global currencies all in one account, making purchasing currencies before travel easy and spending them abroad hassle-free. Plus, its online portal lets you track spending and balances in real time!

Use of a Forex card can save money on currency conversion charges while providing more security than carrying cash abroad. Should your card become lost, report it immediately and they will send another one within 48 hours to replace it.

The IndusInd Bank Multi-Currency Forex Card is an ideal option for any international traveller. Available from numerous banks nationwide and easy to load and use, this convenient card makes using foreign exchange easier than ever – perfect for restaurants, hotels, shops and petrol pumps alike! Plus it comes equipped with a high-security chip for extra protection as well as offering various other advantages such as ISIC membership coverage for lost card liability and counterfeiting as well as insurance protection against lost liability and counterfeiting!

How to apply for IndusInd Bank Multi-Currency Trav

Forex cards provide an easy and safe cashless method of transporting foreign currency while traveling overseas. Widely accepted worldwide, forex cards protect against currency fluctuations while providing you with many features at much reduced costs than credit or debit cards.

With an IndusInd Bank Multi-Currency Travel Card, you can save on currency conversion charges compared to using credit or debit cards, since its exchange rate is locked-in upon loading and will apply throughout your trip. Plus, its international booking/payment capabilities let you book hotels, restaurants, airlines, petrol pumps and shops without incurring extra charges; plus you’ll have instant transaction alerts sent directly to you through an exclusive website!

Apply for a Forex Card online or at any IndusInd Bank branch to keep up to 14 currencies loaded onto it for use overseas, with its embedded high-security chip providing maximum protection. Ideal for students, business travelers and those planning extended stays abroad – you can even keep track of spending using the Travel Card Portal while avoiding inactivity fees once back home!