Firstly, you have to know the procedure to apply for SBI CSP. Once you are aware of the procedure, you can easily apply for this type of banking identity card. Secondly, you should know the company that provides SBI CSP. Lastly, you must know how to open a SBI customer service point.

How to Apply SBI CSP Center

Getting a job with the State Bank of India as a Bank Mitra is not as hard as you may think. All you need is determination and discipline.

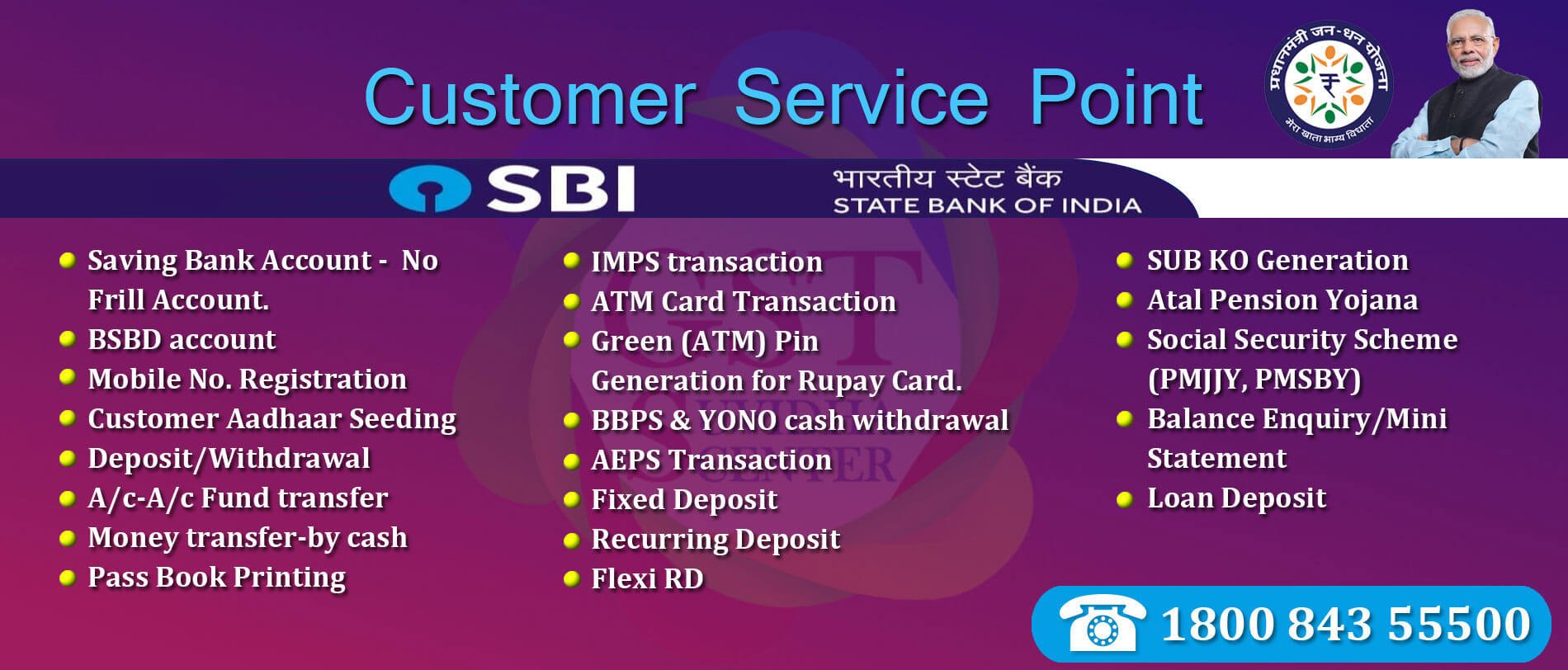

A CSP or Customer Service Point is an organization that helps people in remote villages to access banking services. These organizations offer services such as savings A/C opening, money transfer, loan withdrawal, and deposit funds. These organizations also provide training to people before the centers become operational.

You can apply for a SBI CSP center by going through the online registration process. The first step is to fill out a CSP application form. The form can be downloaded from the State Bank of India website. The form must be filled accurately. You should submit the form with scanned copies of all documents. The application will be scrutinized by the State Bank of India.

After submitting the form, you will receive a login id and password. You will then need to fill out an application form that will ask you to describe your location. You will also need to fill out your personal details.

sBI CSP registration

Applicants who are interested in becoming a Bank CSP can start their journey by following some simple steps. A CSP is a small-scale banking operation that is set up at a remote location to give basic banking services to people living in unbanked villages.

A Bank CSP can be a very lucrative opportunity for a person who wishes to become a full-fledged service provider for a nationalized bank. These providers can offer faster service and improve the customer’s convenience. They also have the potential to generate MIS reports and generate huge amounts of sales.

The best way to go about this is to look for a reliable CSP provider. The service is not expensive and requires little investment. These companies offer a wide range of banking services to their customers, including insurance, government schemes, and specialized banking services.

To be a CSP, an applicant must be at least 18 years old. They should also have basic computer knowledge. The applicant can choose to apply online or offline. They can also choose to work as an external contractor to register clients with the SBI Kiosk Bank.

sBI CSP provider company

Among the large number of banks in India, the state-owned State Bank of India (SBI) stands out. The bank offers a number of customer service points (CSP) across the country. These service points offer a range of banking and financial services. The list includes opening a bank account, depositing and withdrawing money, as well as getting a loan. The bank has also launched a CSP centre program.

A CSP is a mini bank that acts as an extension of the customer’s main bank. The SBI CSP is a great way to establish your own job and make some good money in the process. In addition to banking services, the CSP offers many other services, including loans, savings accounts and insurance. The CSP also makes it possible to open tiny RD accounts.

The SBI CSP may be the only bank in the country to offer this service. The best part is that it is free to join and you can choose from a range of partners. A few of the most popular partners include HDFC, Citibank, Bank of Baroda, HSBC and Standard Chartered.

Which company provides SBI CSP?

Having a State Bank of India customer service point at your disposal is the next best thing to having your own teller. Basically, the CSP is a mini bank that is designed to accommodate customers at their leisure. It is a good way to save time and money. It also enables customers to do banking related transactions at the convenience of their home or office.

The State Bank of India Customer Service Point is one of the most innovative customer service innovations to come out of the bank. It has helped rejuvenate the bank by promoting customer loyalty and ensuring a smooth ride for customers. It is also the harbinger of a reformed banking sector.

One of the most interesting features of the CSP is the fact that the state of the art technology is deployed in a non-descript location. This is the perfect setup for a nascent state bank. Its nifty touchpad technology enables customers to do all of their banking needs from anywhere and anytime. Interestingly, it also enables customers to do the more mundane activities such as opening and maintaining a bank account.

How can I get SBI CSP Center?

Interested persons can apply for CSP by visiting the website of the authorized CSP provider. They will need to upload their scanned copies of documents to complete the application process. Then, they will receive a login ID and password.

After completing the application process, the applicant can access their account and withdraw cash. The CSP offers a wide variety of banking facilities. They also provide ATM withdrawal and money transfer services. It is a great opportunity for the villagers in unbanked areas to attain economic integration goals.

SBI Customer Service Points (CSP) are mini banks that provide customers with essential banking facilities. The operator delivers services like Atal Pension Yojana (APY), Pradhan Mantri Surakshya Bima Yojana (PMSBY), Pradhan Mantri Jevan Jyoti Bima Yojana (PMJJBY) and Jan Dhan Account Opening.

The employees of the SBI Customer Service Points receive a monthly fixed salary from the bank. They also earn handsome commissions from selling insurance policies and pension plans.

The State Bank of India has 72000 CSP outlets in India. They allow customers to access essential banking facilities from the comfort of their homes.

how to open sBI customer service point

Grahak Sahayta Kendra or SBI Customer Service Point is an initiative of the State Bank of India to bring banking services to the doorstep of customers. These kiosks act as mini banks and deliver essential banking services to the rural population.

A SBI customer service point offers a variety of services including cash withdrawal, savings account opening, DTH bill payment and bus ticket booking. These specialised facilities are only offered by authorised SBI CSP. Besides, a SBI customer service point can also earn you big bucks.

SBI is the largest government bank in India and offers a number of banking services. The bank also has a toll free customer care number, available for international and domestic customers. If you are not in a position to visit an SBI branch, you can also apply online for a CSP. You will be required to submit a number of documents including your Pan card, Aadhar card and the most important document – your SBI kiosk.

SBI CSP has been designed to be a cost-effective solution to reduce the load on its main branches. This is achieved through a unique business correspondent model that provides real time financial services to the masses.

SBI kiosk banking identity card

Several banks in India are offering SBI Kiosk Banking facility to their customers. This service enables people in rural and remote areas to get access to basic banking services without visiting a bank branch. It also aims at increasing financial inclusion in India.

With the help of Kiosk Banking, you can open a No-Frills Account, pay bills, conduct NEFT transactions, etc. This service is especially helpful for people who work as minimum wage workers.

To open an account, you will have to complete an application form. You can fill the form online or visit a kiosk. You will also need your identity card, SBI Kiosk Banking wallet opening form, a raashn kaardd (passport), 10vii marksheet, and a fingerprint.

To make an online application, you need to be a resident of India, be at least 18 years old, and have a computer and an active internet connection. You will also need to fill a code of conduct and privacy statement. Once you complete the process, you will receive a welcome kit, which will contain a SBI passbook, a debit card, and a cheque book.

People also ask

How much can I deposit in SBI CSP?

The deposit limit for State Bank of India (SBI) Customer Service Points (CSPs) may vary depending on the bank’s policies and procedures. It’s advisable to check with the local SBI branch or the CSP agent for the current deposit limit. Generally, CSPs allow customers to deposit cash and cheques, and the limit may be set based on factors such as the customer’s account type and deposit history.

How can I apply for SBI CSP online?

To apply for SBI CSP online, you need to follow these steps:

- Visit SBI’s official website: Go to the SBI website and look for the CSP section.

- Fill out the online application form: Complete the online application form with the required personal and professional details.

- Submit the form: Submit the completed form along with the necessary documents, such as ID proof, address proof, educational qualifications, and financial statements.

- Await approval: SBI will review your application and notify you of the approval status.

- Complete the training: If approved, complete the training program and obtain certification as an SBI CSP agent.

How do I apply for CSP bank?

To apply for a Customer Service Point (CSP) for a bank, you need to follow these steps:

- Identify the bank: Choose the bank for which you want to apply for a CSP and check if they have a CSP program.

- Meet the eligibility criteria: Check the eligibility criteria set by the bank and make sure you meet the requirements, such as age, educational qualifications, and financial stability.

- Submit an application: Fill out the CSP application form provided by the bank and submit it along with the required documents, such as ID proof, address proof, educational qualifications, and financial statements.

- Await approval: The bank will review your application and notify you of the approval status.

- Complete the training: If approved, complete the training program and obtain certification as a CSP agent.

- Set up the CSP: Once you have been certified, you can set up the CSP with the required equipment, such as a computer, printer, scanner, and internet connection.

What documents are required for SBI CSP?

The documents required for applying for a State Bank of India (SBI) Customer Service Point (CSP) include:

- ID proof: PAN card, voter ID, Aadhaar card, or passport

- Address proof: Aadhaar card, voter ID, driving license, or utility bill

- Educational qualifications: Educational certificates or diplomas

- Financial statements: Bank statement, income tax return, or balance sheet

- Business registration: If applying as a company, registration documents such as PAN card and GST registration

- Passport size photos

- Agent agreement form

What is eligible for CSP?

To be eligible to become a Customer Service Point (CSP) agent, you need to meet certain criteria set by the bank, which typically include:

- Age: Minimum age limit, usually 18 years or above

- Educational qualifications: Minimum educational qualifications, such as a 10th or 12th standard pass

- Financial stability: Ability to invest in setting up the CSP and meet ongoing operational expenses

- Background check: Clear criminal background check

- Business registration: If applying as a company, registration as a proprietorship, partnership, or limited liability company

- Training: Ability to complete the training program and obtain certification as a CSP agent

What is the benefit of SBI CSP?

There are several benefits of becoming a Customer Service Point (CSP) agent for State Bank of India (SBI), including:

- Income generation: Opportunity to earn a regular income by providing various banking services to customers

- Flexibility: Ability to work from a location of your choice, either at home or in a commercial setting

- Convenience: Ability to provide a range of banking services, such as opening accounts, depositing and withdrawing money, and providing loan services, without the need for customers to visit a bank branch

- Increased visibility: Increased visibility in the community and the opportunity to build a customer base

- Brand recognition: Opportunity to associate with a trusted brand like SBI and benefit from the brand’s recognition and reputation

- Training and support: Access to training and support from the bank, including ongoing assistance with operational and technical issues

Note: The benefits of becoming a CSP agent may vary based on the bank’s policies and procedures. It’s advisable to check with the bank for the latest information and guidelines.Regenerate response

how To open an SBI Seva Kendra

To open an SBI Seva Kendra, you can follow these steps:

- Get in touch with the SBI official: Contact the nearest SBI branch and inquire about the procedure to open a Seva Kendra.

- Meet the eligibility criteria: To open an SBI Seva Kendra, you need to meet certain eligibility criteria, such as having a minimum educational qualification and a certain level of business experience.

- Submit the application: Fill out the application form and submit it along with required documents such as PAN card, Aadhar card, etc.

- Obtain necessary approvals: SBI will review the application and verify the information. If everything is in order, the bank will grant approval for opening a Seva Kendra.

- Set up the center: Once the approval is granted, you can set up the Seva Kendra as per the guidelines provided by SBI.

How long is the CSP exam?

The CSP (Common Service Provider) exam is usually 2 hours long. The exam tests the candidate’s knowledge and skills in various areas, such as computer operations, financial management, and customer service, among others. The exact duration may vary based on the specific requirements of the program and the nature of the exam.

How can I open CSP in PNB?

To open a (CSP) center in Punjab National Bank (PNB), you can follow these steps:

- Check eligibility criteria: Ensure that you meet the eligibility criteria for becoming a CSP center operator. These criteria typically include minimum educational qualifications and business experience.

- Contact PNB: Get in touch with the nearest PNB branch and inquire about the procedure to open a CSP center.

- Submit an application: Fill out the application form and submit it along with the required documents, such as PAN card, Aadhar card, and business registration details.

- Obtain necessary approvals: PNB will review the application and verify the information. If everything is in order, the bank will grant approval for opening a CSP center.

- Complete the training: Attend the mandatory training program provided by PNB to learn about the operations of a CSP center.

- Set up the center: Once the approval is granted and training is completed, you can set up the CSP center as per the guidelines provided by PNB.

ध्यान दें :- ऐसे ही सरकारी योजनाओं BANKING RELATED जानकारी हम आपतक सबसे पहले अपने इस Website के माधयम से आप लोगो तक पहुँचाते रहेंगे paypointbc.in, तो आप हमारे इस Website को फॉलो करना ना भूलें ।

अगर आपको यह आर्टिकल पसंद आया है तो इसे Share जरूर करें ।

इस आर्टिकल को अंत तक पढ़ने के लिए धन्यवाद,,,

नीचे दिए गए सोशल मीडिया के आइकॉन पर क्लिक करके आप हमारे साथ आप जुड़ सकते हैं जिससे आने वाली सभी नई योजना की जानकारी आप तक पहुंचा सके|

APPLY FOR ALL BANK CSP :- BOOK NOW